Table of Content

- Mortgage Tools That Can Help You Compare Options

- Huntington Park, California Home Equity Line of Credit Rates

- Huntington Bank Home Equity Line of Credit

- How to Find the Best HELOC Rate

- Michigan Home Equity Line of Credit

- Home Equity Lines of Credit Can Be Effective Financial Planning Instruments for the Affluent

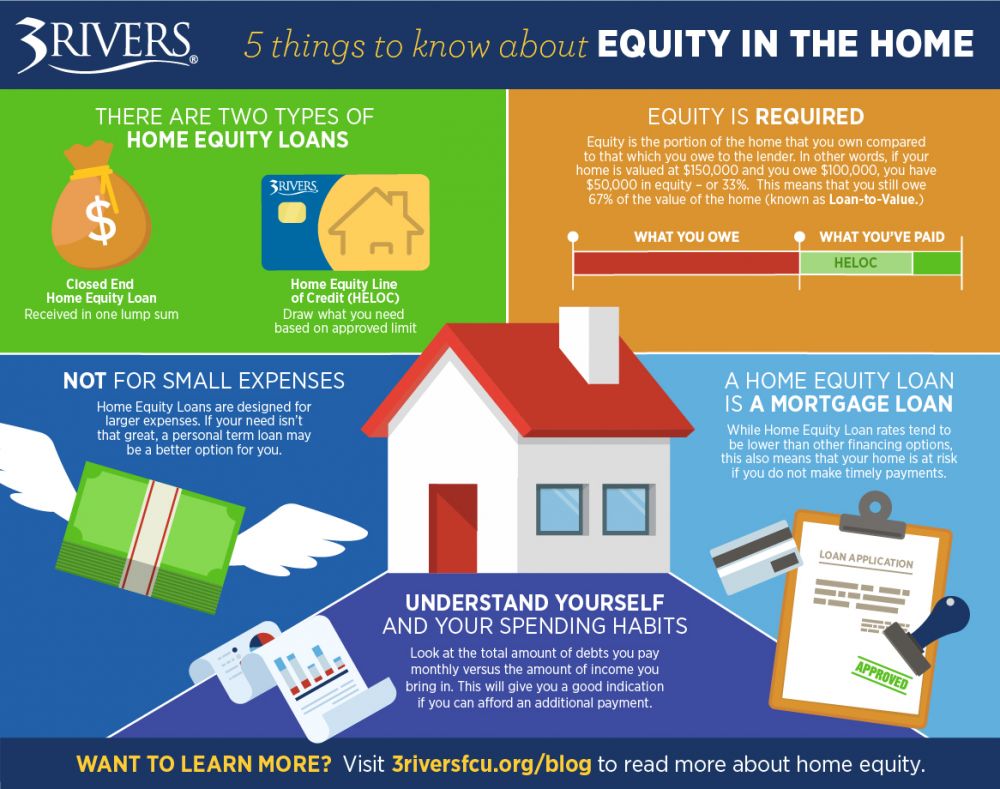

HELOC lenders will lend up to 90% the value of the equity in your home and the typical HELOC line is from $200,000 up to $500,000. "A Home Equity Line of Credit from Peoples Bank is a flexible and affordable solution if you're diving into a home improvement project or funding a major expense like a dream vacation or college education." If you prefer to open your account in person, just stop by your local Huntington branch to meet with a personal banker. Opening an account at Huntington is easy and takes a few clicks online. Visit the Apply Onlinepage and select an account type.

Withdraw funds as you need them to pay for expenses for your home, like renovations. A Home Equity Loan is a lump sum given to you immediately that you pay back over the course of the agreed upon terms. Online account access lets you save time, view your loan balance, monitor transaction history and make payments with free Bill Pay.

Mortgage Tools That Can Help You Compare Options

Depending on customer's qualifications, variable APR's range for line amounts as stated above. Was approved for an equity loan at the end of January. They then hit my credit report with multiple credit check because they let the file lapse due to them dragging their feet. Because of the credit check they then said they can't of give me the original offer because of the credit check lowering my score which they caused because they kept letting the file lapse because they were taking so long. I will be contacting the BBB and also a credit attorney because of the issues they ha e now caused. Please if you are looking for an equity loan please please please find a different lender.

One real risk in a home equity loan is found in the fact that repayment terms are tied to the prime lending rate fluctuates, and may fluctuate greatly. The prime lending rate is more likely to inch up, as opposed to down, over the next few years, as the Federal Reserve raises the Fed Funds rate. Rates from this table are based on loan amount of $50,000 and a variety of factors including credit score and loan to value ratios. Rates may change at any time and are not guaranteed to be correct.

Huntington Park, California Home Equity Line of Credit Rates

Get ongoing access to funds with a home equity line of credit by itself or combined with a first mortgage. ERATE® provides this page to help consumers locate home equity lenders covering Huntington. Our goal is to provide an extensive network of home equity lenders throughout the Huntington area. One-time payments can be scheduled up to one year in advance. Log in at huntington.com/payment to make a payment online. Up to an approved credit limit you can use to access cash, pay for home improvements, unexpected emergencies and more.

To make sure you don't wind up in financial hot water, make a plan for how you're going to use your loan proceeds, including how much you really need to meet those goals – and then stick with it. That means if you're intending to use your loan to pay for tuition, avoid the temptation to slip in a vacation – even if you feel it's well-deserved. Having a plan and knowing your limits are two important steps in responsible – and smart – borrowing. While you're improving your credit report and score, you should also be improving your home to make sure your home appraises for its full value.

Huntington Bank Home Equity Line of Credit

I have plenty of friends who have paid off their mortgages and loans as soon as they came into money, and vowed, ever since, never to take out another loan in their lives. I wouldn't advise betting through market instrumnets one way on another on the direction of interest rates here. But, I’d heed the advice of Gundlach and others not to become too complacent about lower rates. Therefore, if you are thinking about remortgaging or locking in a home equity loan, this is as good of a time as any to take action. The information contained on this website is provided as a supplemental educational resource. Readers having legal or tax questions are urged to obtain advice from their professional legal or tax advisors.

Insurance must be carried on the real property securing the account, and flood insurance must be carried if the structure on the real property is located in a Special Flood Hazard Area. The amount of savings realized with debt consolidation varies by loan. Since a home equity line of credit may have a longer term than some of the bills being consolidated, there may not be a savings over the entire time of the line if you make only the minimum payments. Federally Guaranteed Student Loans and other loans with special government benefits should not be consolidated because you may lose the benefits. For many years, we have written about appropriate and inappropriate reasons to have a home equity line of credit.

Home Equity Loan Rates

Because the appraisal of your home's value will play a big role in determining the size of your home equity loan and the amount of equity you can tap into. It just makes sense to ensure your home looks its best when the appraiser comes to call. Of course, if you're taking out a home equity loan, chances are you don't have a lot of money to spend on major home improvements. But the good news is, you don't have to sink a lot of money into your home to impress your appraiser. Choose from home equity loans, first mortgage equity loans, or home equity lines of credit to help you renovate, or remodel, pay tuition or consolidate debt. Whatever your plans, Huntington can help with mortgage options, equity options, and more to help you achieve your goal.

To pay your mortgage from an account at another bank, visit the My Accounts - Overview page and click Pay Now. To see a list of our current lending products and determine which option is right for you, visit our Loans and Lines of Credit page. Whether it's an emergency, remodeling or home improvement, Huntington offers you the flexibility to start a project with a loan that can be paid over a period of time.

If you are the owner of the logo and wish for us to remove or change the logo, please contact us. You may estimate this amount, but to be more accurate consult your most recent statement. If you wish to take cash out when you consolidate, enter that amount as a loan balance. Asterisk-Free Checking® and Voice Credit Card® are federally registered service marks of Huntington Bancshares Incorporated.

Repayment terms are tied to the prime lending rate and that rate is likely to move up – perhaps dramatically - over the next few years as the Federal Reserve raises the Fed Funds rate. A 10-year home equity loanor a 15-year home equity loan, however, may be a safer option at this time. Depending on your personal circumstances, you should also consider mortgage refinance options. More Info The Figure Home Equity Line is an open-end product where the full loan amount will be 100% drawn at the time of origination. The initial amount funded at origination will be based on a fixed rate; however, this product contains an additional draw feature.

Let’s examine the basics of home equity lines of credit first in order to understand what makes them appealing. First, home equity lines of credit are typically less costly and more flexible than home equity loans. Importantly, as the borrower, you only borrow the amount that you need, and thus you only pay interest on the amount that you need and draw.

No matter where you choose to make your payments, Huntington gives you options. Online account management makes it easy to access your line of credit whenever you need it. A Home Equity Line of Credit can pay for home improvements, unexpected emergencies and more. And you can access your credit line for an initial 10 years without reapplying.

As the borrower repays the balance on the line, the borrower may make additional draws during the draw period. Accordingly, the fixed rate for any additional draw may be higher than the fixed rate for the initial draw. Home Equity Loans are subject to credit application, approval and acceptable appraisal and title search.

As you see in the table above, the pricing of a home equity line of credit varies from lender to lender. HELOC rates are based on the prime lending rate (“prime”) - the rate that commercial banks charge their most creditworthy customers. If you're applying for a home equity loan - or any type of loan or credit - the first thing you should do is check your credit report. Your credit report is used to determine your credit score – and your score, in turn, can determine whether or not you qualify for a loan.

No comments:

Post a Comment